Have you ever thought about “How Do Investment Returns Work?” The profit or loss you make from investing your money is known as an investment return. It is important to thoroughly understand how investment returns work to make wise financial decisions. This article explores the various aspects of investment returns, including types of returns, factors influencing them, and how they are calculated.

Understanding Investment Returns

The profit or loss you make when investing in assets like stocks or bonds is known as investment returns. Usually given as a percentage, it reflects how your investment has grown over time.

If you invest $1,000 in stock and its value increases by 10% over a year, you will receive a return of $100, which is an example of how investment returns work. However, if the value of your investment decreases, the return can potentially be negative. Understanding how returns work is essential to make wise financial decisions.

Types of Investment Returns

Making wise financial decisions needs an understanding of investment returns. It represents the profits from your investments and can vary in complexity. By learning about different return types, investors can better grasp how their money grows over time and make smarter choices to achieve their financial goals. Investment returns can be classified into two main categories: income returns and capital gains.

- Income Returns:

- Dividends: These are payments made by a corporation to its shareholders, usually in the form of cash or additional stocks. Generally, dividends are paid by reputable businesses with stable profits.

- Interest: This is the return earned from investments such as bonds, savings accounts, or certificates of deposit (CDs). In exchange for investors borrowing their money, the bond issuer pays them interest.

- Capital Gains:

- Realized Capital Gains: These occur when you sell an asset for more than its purchase price. For example, if you buy a stock at $50 and sell it at $70, you realize the capital gain will be $20.

- Unrealized Capital Gains: These are the paper gains on investments that you have not yet sold. For example, a $20 profit is unrealistic if the value of your stock increases from $50 to $70 without selling.

Understanding the Performance of Investment

Investing is like planning a trip. Understanding whether your investments are bringing you closer to your financial goals is important. Whether you handle your investments, get help from a professional, or want to learn more before starting, it is critical to understand how well your assets are performing.

If you are searching about how do investment returns work? Here are some of the most important factors to be aware of when considering the best strategy for understanding investment returns work:

Understanding Returns

Returns demonstrate the amount you gained or lost on an investment over a certain period. They are displayed as part of your initial investment. For example, if you invest $1,000 and get a 10% return, you will make a profit of $100. Returns can be zero (also called “flat returns”), positive (you make money), negative (you lose money), or zero (you neither make nor lose money).

Reinvestment and Compounding

Reinvesting your earnings is the best way to grow your savings. Let’s take an example where you invest $1000 today and predict it will grow 10% annually. You will still have $1000 in returns and $100 next year. You reinvest that $100 instead of spending it. As a result, you are now earning 10% on $1100. Now, you receive the benefit of compound growth.

Monitoring and Improvement

Monitoring and improvement are the most important to understand how investment returns work. Keep an eye on your investments and be ready to change your plan when the market changes. You may need to monitor your investment mix in response to fluctuations in asset prices to maintain an appropriate degree of risk for yourself. Additionally, consider monitoring your plan in response to life events such as marriage, a new job, or caring for an aging parent.

The Inflation Effect

The increase in the price of everyday goods is called inflation. As a result, the value of your money decreases because you cannot buy as much with each dollar. To maintain the same value of your money, it is important to determine whether your investments are outpacing inflation.

If you want to make sure your money grows more than inflation, be sure to take on only the amount of risk you are comfortable with and can handle financially. Investors need to maximize their profits by taking all appropriate steps. Here are some useful tips to improve your investment strategy:

Tips for Maximizing Investment Returns

The next topic of the article “How do investment returns work?” is maximizing investment returns. Investors need to maximize their profits by taking all appropriate steps. Here are some useful tips to improve your investment strategy:

Diversify Your Investment Portfolio

Although investing carries some risk, there are strategies to reduce risk and improve the chances that your money will grow. Diversification is an important strategy to reduce losses and promote financial growth.

Investing in different markets and asset classes, including stocks, bonds, commodities, and real estate, is known as diversification. This way, if some assets perform poorly, other investments can perform better and provide balance. However, if you invest all your money in just one or two stocks, you are taking a big risk.

Invest for the Long-Term

Typically, long-term investing involves holding an asset, such as stocks, or real estate, for three years or more. Generally, long-term investments have a greater profit potential. The value of your portfolio can grow substantially over time through compound interest and capital gains.

Opportunity cost is the main downside of long-term investing. Long-term investment restricts the funds from being used for other ventures, especially those with the potential for rapid profits. But, if long-term investment builds good returns, this will be fine.

Match Your Maturity

The third step to getting the most out of your investments while keeping risks low is to match the time when you will need your money with the time when your investments will pay off.

Make sure your investments are ready when you need to pay for things in the future. For example, if you need to pay for something soon, like wages or taxes, use a short-term investment like a money market fund or a Treasury bill. Doing this will avoid problems with cash flow, interest rates, and missing better opportunities.

Calculating Investment Returns

Investment returns can be calculated in different ways depending on the type of investment and the information available. Here are a few common methods that help to understand how investment returns work for individuals:

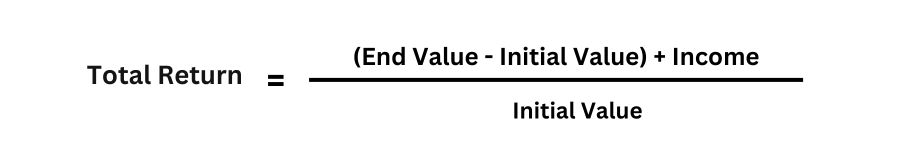

Total Return

Total returns include both income (interest or dividends) and capital gains. It is calculated as follows:

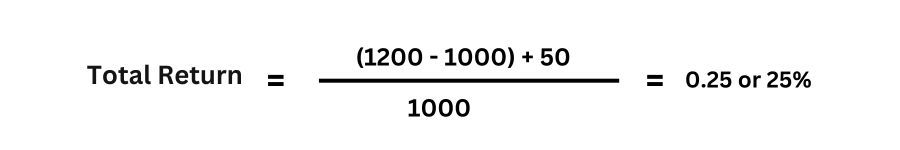

For example, if you invest $1,000 in a stock, and its value increases to $1,200, and you receive a $50 dividend, your total return will be:

Annualized Return

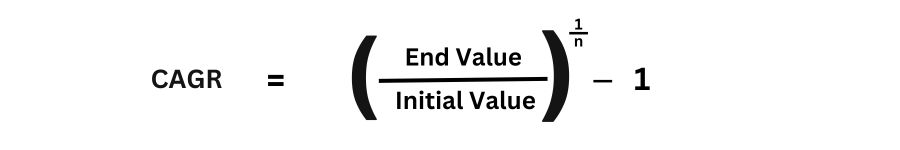

Annualized return, or compound annual growth rate (CAGR), shows the rate at which an investment grows annually over a specific time. It is calculated using the formula:

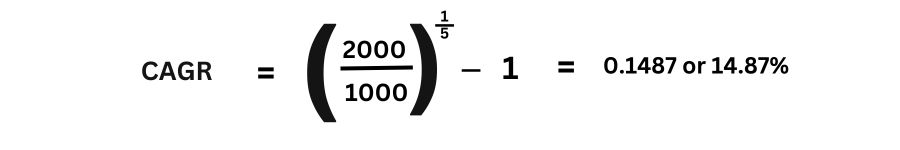

where 𝑛 is the number of years. For example, if you invest $1,000 and it grows to $2,000 over 5 years, the CAGR is;

Annualized return, or compound annual growth rate (CAGR), shows the rate at which an investment grows annually over a specific time. It is calculated using the formula.

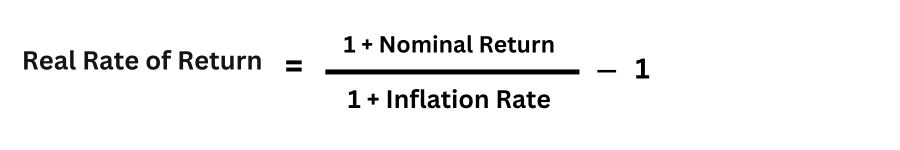

Real Rate of Return

The real rate of return adjusts for inflation, providing a more accurate measure of investment performance. It is calculated as:

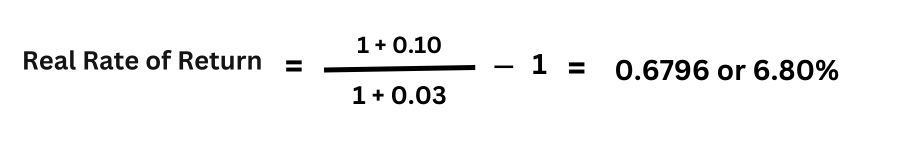

For example, if your nominal return is 10% and the inflation rate is 3%, the real rate of return is:

Conclusion

Investment returns are a measure that investors use to see how much profit they invested. It also helps to compare how well different investments are doing. Anyone who wants to grow their money must know how investment returns work.

If you understand the different types of returns, the performance of investment, and methods to calculate returns, you can choose options wisely. Additionally, smart strategies like investing in the long term can help you get the most out of your investments.

If you like to read the article How Do Investment Returns Work?, please share it with your friends and family members.

FAQs: How Do Investment Returns Work

What is Investment?

Investment involves allocating money or resources to an asset to build income or profit over time.

How do investments generate returns?

Investment generate returns through capital appreciation like an increase in asset value and income like dividends, interest, or rent. The specific mechanism will vary depending on the type of investment.

Read More:

How Does Investment Work Explain?

What is Investment and its Importance?

How to Choose a Good Investment?

Hi everyone, my name is Sharda Kumari, founder of basicfinanceliteracy.com. My love for writing about finance comes from my personal experiences, including investing, saving, and learning from mistakes along the way. I share simple, easy, and honest articles on investing, saving, and financial planning. There is no complex language, no excessive advice, simply useful advice that anybody can follow.

My goal is to make financial literacy feel less like a complicated subject and more like a life skill we all deserve to learn. If you have ever felt lost trying to figure out where to start with money, you are not the only person who thinks like this, and now, you are in the right place.

Thanks for being part of this journey. Let’s grow wiser with money together.